搜尋結果

$936Mr.R 素色短袖 休閒短袖 網紅超火cec短袖 男潮牌 寬鬆港風t恤 翻領polo衫 ins潮流帥氣 5~坤坤好物~Y5650565752

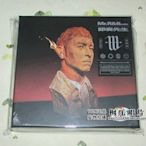

$936Mr.R 素色短袖 休閒短袖 網紅超火cec短袖 男潮牌 寬鬆港風t恤 翻領polo衫 ins潮流帥氣 5~坤坤好物~Y5650565752 $1015【全新現貨】潘瑋柏 節奏先生 Mr.R&Beats 正式版CD雅虎黃豆精品唱片

$1015【全新現貨】潘瑋柏 節奏先生 Mr.R&Beats 正式版CD雅虎黃豆精品唱片 $3165原創Lolita 怪盜布偶兔子MR.R古典歐美華麗 洛麗塔op短袖連衣裙-雙喜生活館Y6233681732

$3165原創Lolita 怪盜布偶兔子MR.R古典歐美華麗 洛麗塔op短袖連衣裙-雙喜生活館Y6233681732 $1017書山碟海~潘玮柏 Mr.R&Beats 节奏先生 2CD+76页写真時光光碟 CD碟片 樂樂~樂樂*#V#

$1017書山碟海~潘玮柏 Mr.R&Beats 节奏先生 2CD+76页写真時光光碟 CD碟片 樂樂~樂樂*#V#![Mr.R 素色短袖 休閒短袖 網紅超火cec短袖 男潮牌 寬鬆港風t恤 翻領polo衫 ins潮流帥氣 5~喜喜好物~ Mr.R 素色短袖 休閒短袖 網紅超火cec短袖 男潮牌 寬鬆港風t恤 翻領polo衫 ins潮流帥氣 5~喜喜好物~]() $918Mr.R 素色短袖 休閒短袖 網紅超火cec短袖 男潮牌 寬鬆港風t恤 翻領polo衫 ins潮流帥氣 5~喜喜好物~Y1510626896

$918Mr.R 素色短袖 休閒短袖 網紅超火cec短袖 男潮牌 寬鬆港風t恤 翻領polo衫 ins潮流帥氣 5~喜喜好物~Y1510626896![合友唱片 潘瑋柏 / Mr.R&Beats (節奏先生) CD 合友唱片 潘瑋柏 / Mr.R&Beats (節奏先生) CD]() $510合友唱片 潘瑋柏 / Mr.R&Beats (節奏先生) CD合友唱片

$510合友唱片 潘瑋柏 / Mr.R&Beats (節奏先生) CD合友唱片![【現貨】潘瑋柏 Mr.R&Beats 節奏先生 2CD+76頁寫真 【現貨】潘瑋柏 Mr.R&Beats 節奏先生 2CD+76頁寫真]() $949【現貨】潘瑋柏 Mr.R&Beats 節奏先生 2CD+76頁寫真綠島golf~~

$949【現貨】潘瑋柏 Mr.R&Beats 節奏先生 2CD+76頁寫真綠島golf~~![❥ 好野音像 【全新】潘瑋柏 節奏先生 Mr.R&Beats 正式版CD ❥ 好野音像 【全新】潘瑋柏 節奏先生 Mr.R&Beats 正式版CD]() $1030❥ 好野音像 【全新】潘瑋柏 節奏先生 Mr.R&Beats 正式版CD❥ 好野音像

$1030❥ 好野音像 【全新】潘瑋柏 節奏先生 Mr.R&Beats 正式版CD❥ 好野音像![角落唱片* 【全新】潘瑋柏 節奏先生 Mr.R&Beats 正式版CD 角落唱片* 【全新】潘瑋柏 節奏先生 Mr.R&Beats 正式版CD]() $1030角落唱片* 【全新】潘瑋柏 節奏先生 Mr.R&Beats 正式版CD角落唱片

$1030角落唱片* 【全新】潘瑋柏 節奏先生 Mr.R&Beats 正式版CD角落唱片![昌運監視器 SOYAL AR-0600M-R 嵌入式埋入式 磁力鎖 抗拉力250KG 鎖具 昌運監視器 SOYAL AR-0600M-R 嵌入式埋入式 磁力鎖 抗拉力250KG 鎖具]() $2607昌運監視器 SOYAL AR-0600M-R 嵌入式埋入式 磁力鎖 抗拉力250KG 鎖具購物中心

$2607昌運監視器 SOYAL AR-0600M-R 嵌入式埋入式 磁力鎖 抗拉力250KG 鎖具購物中心![妙屋智造 MR HG 144 R魂 對戰地台 展示地台 鐵管支架通用 妙屋智造 MR HG 144 R魂 對戰地台 展示地台 鐵管支架通用]() $558妙屋智造 MR HG 144 R魂 對戰地台 展示地台 鐵管支架通用福氣滿滿

$558妙屋智造 MR HG 144 R魂 對戰地台 展示地台 鐵管支架通用福氣滿滿![《GTS》純日貨 GSI 郡氏 MP-242 Mr.Metal Primer-R 金屬底漆 111552 《GTS》純日貨 GSI 郡氏 MP-242 Mr.Metal Primer-R 金屬底漆 111552]() $250《GTS》純日貨 GSI 郡氏 MP-242 Mr.Metal Primer-R 金屬底漆 111552【GUN&TOYS】

$250《GTS》純日貨 GSI 郡氏 MP-242 Mr.Metal Primer-R 金屬底漆 111552【GUN&TOYS】

外僑稅務FAQ. 何謂「外僑統一證號」?. 由何機關配賦及如何編排?. 更新日期:113-04-22. 自96年1月2日起: (一)由內政部移民署針對港澳、大陸地區人民及華僑於核發臺灣地區居留證時,配賦統一證號。. (二)由內政部移民署針對一般之外僑於核發外僑居留證時,配 ...

- Alien Individual Income Tax and The Period of Residence

- Income from Sources in The R.O.C.

- Computation of Residence

- Determination of Income

- When Tax Payment Is Due

- Tax Services

- Filing Individual Income Tax Return Online

- The Papers and Documents to Be Submitted When Filing Individual Income Tax

- Scope of Exemptions

- Deduction For Investing in Innovative Startups

For any alien having income from sources in the Republic of China (R.O.C.), individual income tax shall be levied on the income derived from such sources in accordance with the Income Tax Act of the R.O.C. Alien taxpayers can be categorized as “Non-Residents of the R.O.C.” and “Residents of the R.O.C.” based on their length of stay. The different w...

The following categories are considered income from sources in the R.O.C. (1) Dividends distributed by companies incorporated and registered in accordance with the Company Act of the R.O.C. and by foreign companies authorized by the Government of the R.O.C. to operate within the R.O.C. (2) Profits distributed by profit-seeking enterprises organized...

The computation of an alien’s period of residence in the R.O.C. is based on the dates stamped on his/her passport or the Certificate of Entry and Exit Dates issued by the National Immigration Agency, Ministry of the Interior (excluding the date of arrival and including the date of departure). If an alien enters and exits this country a number of ti...

For an alien who remains in the R.O.C. within one taxable year: (1) Not more than 90 days: A. The income tax shall be withheld at the income sources or declared and taxed in accordance with the withholding rate. B. The income tax shall be exempted form income derived from employer(s) outside the R.O.C. (2) More than 90 days: A. The income derived w...

The tax payment due is different for aliens staying for different lengths of time in the R.O.C. (1) For an individual staying in the R.O.C. for not more than 90 days, the income tax payable shall be withheld directly at the time of payment by the withholder in accordance with the withholding rate. However, in the case that an individual has sole or...

(1) An alien shall file his/her individual income tax return to the competent tax collection authority, which has jurisdiction to the location of the address given on his/her Alien Resident Certificate. (2) An alien, who stays in Taipei City, shall file his/her tax return at the Foreign Taxpayer Service Section, National Taxation Bureau of Taipei, ...

Any alien (excluding Mainland Chinese) with a valid resident certificate and ARC No. issued by the National Immigration Agency may file an individual income tax return online for the year 2023 from May 1st, 2024 to May 31st, 2024. After downloading the electronic tax-filing program at https://tax.nat.gov.tw, taxpayers can log into the system via an...

A valid passport, tax withholding statement, dividend statement, certificate of residence, and certificate of earnings paid abroad for services rendered in the R.O.C. are basic data. Furthermore, if a taxpayer with special qualifications seeks to apply for tax exemptions or deductions, the proper documents of evidence should be submitted to the tax...

The following categories of income can be exempted by submitting the necessary documents: (1) Scholarships and subsidies granted by governments of the R.O.C. or foreign governments; international institutions; educational, cultural, and scientific research organizations or associations; and other public or private organizations for the encouragemen...

For an individual, who invests at least NT$1 million in cash in one year in R.O.C.'s innovative startups which have been incorporated for less than 2 years and identified by the central authority in charge of relevant enterprises as high- risk innovative startups, and acquires and holds the new shares issued by the company for 2 years, up to 50 per...

首頁. 稅務資訊. 認識稅務. 稅務問與答. 國稅問與答. 綜合所得稅. 柒、所得基本稅額條例相關問題. 六、個人海外所得課徵基本稅額相關問題. 1740 個人海外所得計入基本所得額之年度? 1741 個人海外所得之範圍及項目或類別為何? 1742 那些人之海外所得須計入基本所得額? 1743 個人海外所得計入基本所得額之門檻為何? 1744 海外所得達100萬元者,是不是就必須繳納基本稅額? 1745 海外所得在海外繳納之所得稅可否全數扣抵基本稅額? 1746 來臺工作之外籍專業人士或外國特定專業人才,其海外所得是否須辦理申報? 1747 98年12月31日以前申購之境外基金受益憑證於99年度以後贖回,如何計算所得?

國稅問與答. 綜合所得稅. 壹、課稅範圍. 1103 所得稅法規定「中華民國境內居住之個人」與「非中華民國境內居住之個人」如何區分? 更新日期:110-10-06. 下面兩種是屬於「中華民國境內居住之個人」: 1.在我國境內有住所,並經常居住我國境內的人。 自102年1月1日起,所得稅法第7條第2項第1款所稱中華民國境內居住的個人,其認定原則如下: (1)個人於一課稅年度內在中華民國境內設有戶籍,且有下列情形之一者: A.於一課稅年度內在中華民國境內居住合計滿31天。 B.於一課稅年度內在中華民國境內居住合計在1天以上未滿31天,其生活及經濟重心在中華民國境內。

線上申辦線上查調電子稅務文件線上稅務試算公示資料查詢電子申報繳稅服務. 書表及檔案下載. 申請書表及範例下載免費軟體下載繳款書種類及格式. 交流園地. 國稅信箱地方稅信箱網站信箱稅務機關連結. 稅額試算. 稅額試算專區遺產稅稅額試算專區. 境外電商 ...

線上服務. 線上稅務試算. 簡易估算國稅稅額. 綜合所得稅試算. ※本程式僅提供簡易估算稅額功能,實際應納稅額請另依申報書填寫計算。 綜所稅試算:僅供參考 (112年) (本試算服務對於有配偶者,僅提供納稅義務人及配偶所得採合併計算稅額方式估算,另有股利所得者及薪資收入採必要費用減除者不適用本試算服務) 婚姻狀況. ( 綜合所得總額 - 免稅額 - 扣除額 )x 稅率 = 綜合所得稅. 一. 綜合所得總額. 薪資: (憑單格式代號50) A.本人薪資收入. 元. 薪資所得特別扣除額. 元. 薪資所得. 元. B.配偶薪資收入. 元. 薪資所得特別扣除額. 元. 薪資所得. 元. C.扶養親屬薪資收入. 元. 薪資所得特別扣除額. 元. 薪資所得. 元. 利息: (憑單格式代號5A) 元.

國稅問與答. 營利事業所得稅. 貳、營利事業所得額之計算─營業收入(共計11題) 營利事業發生銷貨退回或銷貨折讓時,應如何處理? (2103) 更新日期:106-03-20. 營利事業發生銷貨退回時,應在退回年度帳簿紀錄沖轉,並依統一發票使用辦法第20條規定取得憑證,或有其他確實證據證明銷貨退回事實者,應予認定。 如未取得有關憑證或證據者,不能列報銷貨退回,其按銷貨認定之收入,稽徵機關依同業利潤標準核計其所得額。 外銷貨物之退回,其能提示海關之退貨資料等有關證明文件者,經稽徵機關查明後核實認定。 營利事業之銷貨於次年度發生退回,其銷貨退回因所屬會計年度不同,應列為次年度銷貨退回處理。